Menu

| Home | > | Reports | > | Reports and Interfaces | > | GST |

Mandatory Prerequisites

Prior to printing a GST Report, refer to the following Topics:

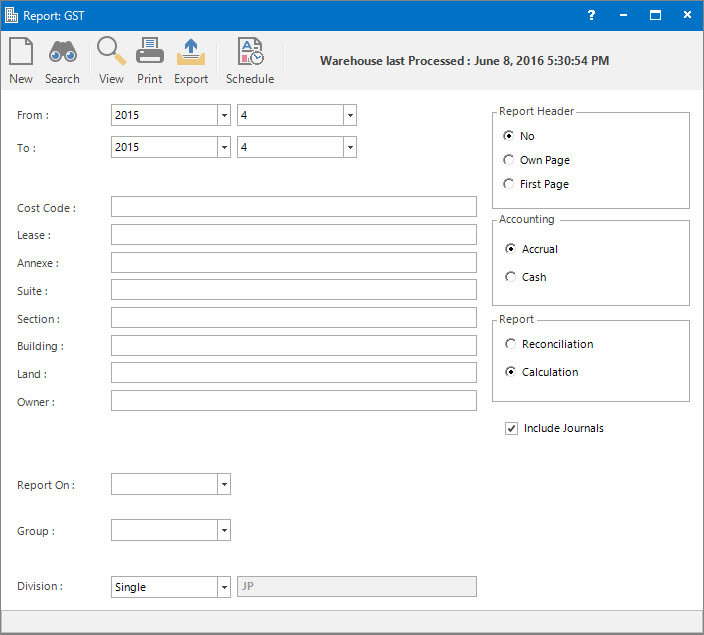

Screenshot and Field Descriptions

From (Year / Period): this is the Accounting Period to run the report from.

To (Year / Period): this is the Accounting Period to run the report to.

Cost Code, Lease, Annexe, Suite, Section, Building, Land, Owner: these selection fields are optional and can be used to filter the report by.

Report On: this is a drop down list of Property / Lease and other entities that the report can be grouped by.

Group: this is a drop down list of the Property / Lease and other entity Groups that the selection can be filtered on. Select a value from the drop down list and the appropriate filter field will be displayed.

Division: this is a the option to report on a Single Division that the user is logged into or Multiple Divisions.

Report Options

Report Header: this is the options for displaying the report header on the report.

Account: this is the option to select which accounting method, Accrual or Cash, to report on.

Report: this is the option to view / print the different reports:

- Reconciliation: select to check for any anomalies with the recording of GST for the period.

- Calculation: select to see the summarised amounts in a format similar to the Business Activity Statement (BAS) required by the Australian Tax Office.

Include Journals: tick this check box to include General Ledger Journal transactions in the report.

How Do I : Print a report to check the entry of GST is correct

This report runs off the Reporting Data Warehouse. Therefore, make sure the Robot - Warehouse process has been run first to report on up to date data.

How Do I : Print a GST report for filling out the BAS required by the ATO

This report runs off the Reporting Data Warehouse. Therefore, make sure the Robot - Warehouse process has been run first to report on up to date data.

Printing the GST Report is associated with the following Topics: